Travel Reimbursement Nontaxable . Many categories, however, have specific guidelines that govern their taxability, so it's important. But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. in short, no. for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. do i have to pay taxes on travel reimbursement paid to me by my employer? If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally. Yes, this was a reimbursement but the.

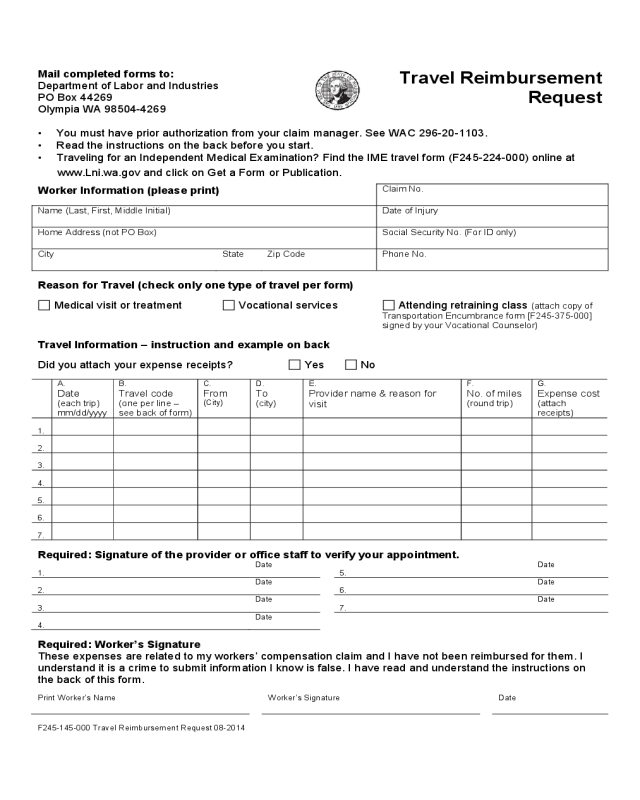

from handypdf.com

for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. Many categories, however, have specific guidelines that govern their taxability, so it's important. If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally. in short, no. Yes, this was a reimbursement but the. do i have to pay taxes on travel reimbursement paid to me by my employer?

2024 Travel Reimbursement Form Fillable, Printable PDF & Forms Handypdf

Travel Reimbursement Nontaxable Yes, this was a reimbursement but the. in short, no. Yes, this was a reimbursement but the. Many categories, however, have specific guidelines that govern their taxability, so it's important. do i have to pay taxes on travel reimbursement paid to me by my employer? But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally.

From slidesdocs.com

Travel Expense Reimbursement Form Excel Template And Google Sheets File For Free Download Travel Reimbursement Nontaxable But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. Yes, this was a reimbursement but the. do i have to pay taxes on travel reimbursement paid to me by my employer? in short, no. for tax years beginning after 2017, reimbursement you receive from your employer for the purchase,. Travel Reimbursement Nontaxable.

From www.sampleforms.com

FREE 5+ Travel Expense Reimbursement Forms in PDF MS Word Excel Travel Reimbursement Nontaxable But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. Many categories, however, have specific guidelines that govern their taxability, so it's important. Yes, this was a reimbursement but the. in short, no. If you use your own car for work purposes and are reimbursed by your employer for the related expenses,. Travel Reimbursement Nontaxable.

From slideplayer.com

Lesson 2Continued. ppt download Travel Reimbursement Nontaxable do i have to pay taxes on travel reimbursement paid to me by my employer? for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. Many categories, however, have specific guidelines that govern their taxability, so it's important. in short, no. But that’s provided your employer completes. Travel Reimbursement Nontaxable.

From busfin.uga.edu

Travel Reimbursement Steps University of Travel Reimbursement Nontaxable Yes, this was a reimbursement but the. do i have to pay taxes on travel reimbursement paid to me by my employer? for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. If you use your own car for work purposes and are reimbursed by your employer for. Travel Reimbursement Nontaxable.

From www.generalblue.com

Travel Reimbursement Form in PDF (Simple) Travel Reimbursement Nontaxable for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. do i have to pay taxes on travel reimbursement paid to me by my employer? But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. Yes, this was a reimbursement but. Travel Reimbursement Nontaxable.

From www.patriotsoftware.com

Travel Reimbursement Policy Sections to Include & More Travel Reimbursement Nontaxable do i have to pay taxes on travel reimbursement paid to me by my employer? If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally. Yes, this was a reimbursement but the. But that’s provided your employer completes the pay stub accurately as part of their. Travel Reimbursement Nontaxable.

From www.airslate.com

Travel Reimbursement airSlate Travel Reimbursement Nontaxable in short, no. Yes, this was a reimbursement but the. do i have to pay taxes on travel reimbursement paid to me by my employer? for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. But that’s provided your employer completes the pay stub accurately as part. Travel Reimbursement Nontaxable.

From www.sampleforms.com

FREE 13+ Travel Reimbursement Forms in PDF Ms Word Excel Travel Reimbursement Nontaxable do i have to pay taxes on travel reimbursement paid to me by my employer? in short, no. Yes, this was a reimbursement but the. If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally. Many categories, however, have specific guidelines that govern their taxability,. Travel Reimbursement Nontaxable.

From smbcart.com

Travel Reimbursement Travel Expense Reimbursement SMB CART Travel Reimbursement Nontaxable If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally. Many categories, however, have specific guidelines that govern their taxability, so it's important. But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. in short, no. Yes, this was. Travel Reimbursement Nontaxable.

From slideplayer.com

Travel Reimbursements ppt download Travel Reimbursement Nontaxable But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. in short, no. do i have to pay taxes on travel reimbursement paid to me by my employer? for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. Many categories,. Travel Reimbursement Nontaxable.

From www.sampleforms.com

FREE 7+ Sample Travel Reimbursement Forms in MS Word PDF Excel Travel Reimbursement Nontaxable do i have to pay taxes on travel reimbursement paid to me by my employer? But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. Yes, this was a reimbursement but the. If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the. Travel Reimbursement Nontaxable.

From slideplayer.com

UO Travel Policy for American English Institute Aug. 25, ppt download Travel Reimbursement Nontaxable do i have to pay taxes on travel reimbursement paid to me by my employer? But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. Yes, this was a reimbursement but the. for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of. Travel Reimbursement Nontaxable.

From www.generalblue.com

Travel Reimbursement Form in Excel (Simple) Travel Reimbursement Nontaxable But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. in short, no. Yes, this was a reimbursement but the. for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. If you use your own car for work purposes and are. Travel Reimbursement Nontaxable.

From www.sampleforms.com

FREE 13+ Travel Reimbursement Forms in PDF Ms Word Excel Travel Reimbursement Nontaxable But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. do i have to pay taxes on travel reimbursement paid to me by my employer? Many categories, however, have specific guidelines that govern their taxability, so it's important. Yes, this was a reimbursement but the. If you use your own car for. Travel Reimbursement Nontaxable.

From www.editableforms.com

Travel Reimbursement Form Editable PDF Forms Travel Reimbursement Nontaxable But that’s provided your employer completes the pay stub accurately as part of their expense reimbursement process. in short, no. Yes, this was a reimbursement but the. for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. Many categories, however, have specific guidelines that govern their taxability, so. Travel Reimbursement Nontaxable.

From www.sampleforms.com

FREE 13+ Travel Reimbursement Forms in PDF Ms Word Excel Travel Reimbursement Nontaxable for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. do i have to pay taxes on travel reimbursement paid to me by my employer? If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally.. Travel Reimbursement Nontaxable.

From www.fec.gov

Reimbursement of personal funds spent for nontravel expenses Travel Reimbursement Nontaxable for tax years beginning after 2017, reimbursement you receive from your employer for the purchase, repair, or storage of a. Many categories, however, have specific guidelines that govern their taxability, so it's important. Yes, this was a reimbursement but the. do i have to pay taxes on travel reimbursement paid to me by my employer? in short,. Travel Reimbursement Nontaxable.

From slidesdocs.com

Travel Expense Reimbursement Employee Salary Management Excel Template And Google Sheets File Travel Reimbursement Nontaxable Yes, this was a reimbursement but the. If you use your own car for work purposes and are reimbursed by your employer for the related expenses, the mileage reimbursement generally. in short, no. Many categories, however, have specific guidelines that govern their taxability, so it's important. for tax years beginning after 2017, reimbursement you receive from your employer. Travel Reimbursement Nontaxable.